Claim Your $7,500 Solar Tax Credit

The U.S. Inflation Reduction Act signed into law in 2022 contains hundreds of billions of dollars to lower healthcare costs and to build roads, bridges, and public buildings. It also contains a huge tax credit for rooftop solar panels that every health professional and practice manager should consider for their home or business. Act now to take advantage of up to $7,500 in tax credits for 2023! Whether you live in the United States or elsewhere, this five minute blog from My Green Doctor explains the nuts and bolts of adding solar panels and backup battery power.

The U.S. Inflation Reduction Act signed into law in 2022 contains hundreds of billions of dollars to lower healthcare costs and to build roads, bridges, and public buildings. It also contains a huge tax credit for rooftop solar panels that every health professional and practice manager should consider for their home or business. Act now to take advantage of up to $7,500 in tax credits for 2023! Whether you live in the United States or elsewhere, this five minute blog from My Green Doctor explains the nuts and bolts of adding solar panels and backup battery power.

“Rooftop solar” means paying a licensed solar power contractor to install photovoltaic panels onto the roof of your home or business to create electricity that can be used to provide power to the building, to charge an electric car, as backup when the electricity grid fails, or as electricity to sell to your local utility company. The solar industry has matured over the past twenty years so that today’s solar panels are far more efficient and less expensive. A typical rooftop solar project will save the owner $60,000 or more over the twenty-five year life of the panels.1 If you own a home or a business with an unshaded roof, now is the time to install solar panels and to claim your tax credit.

“A typical rooftop solar project will save the owner $60,000 or more…”

The solar tax provision in the Inflation Reduction Act (IRA) is called the Investment Tax Credit (ITC). It provides a direct tax credit for individuals or businesses installing solar photovoltaic panels, buying backup batteries, electrifying vehicle fleets, and or investing in clean energy infrastructure including charging stations. The ITC will lower your tax bill by 30% of the cost of your solar system, up to a maximum of a $7500 credit. The credit does not begin to decrease until 2032 but it is best to act now because Congress could change its mind next year.2

batteries, electrifying vehicle fleets, and or investing in clean energy infrastructure including charging stations. The ITC will lower your tax bill by 30% of the cost of your solar system, up to a maximum of a $7500 credit. The credit does not begin to decrease until 2032 but it is best to act now because Congress could change its mind next year.2

You will find licensed solar power contractors online or at your electric company’s website. Their representative will come to your property at no cost and give you a written estimate of the cost of solar panels and of other options such as back-up batteries and solar hot water systems. You will receive an estimate of how much electricity your panels are likely to generate each month, your monthly electricity and greenhouse gas savings, the amount of your Federal tax credit, and any local or state credits that may be available. You will be told when you are likely to recover the cost of your investments based upon the average sun exposure where you live. A reputable company will provide the names of prior customers for you to speak with. If you do not live in the United States, ask a solar power installer or your electricity company what government benefits are available in your country.

Keep in mind that your goal is to save money by generating only part of your electricity from the sun. You will continue to buy some power from the electric utility. However, the ITC can be used also to buy batteries to store solar energy in the daytime that can be used at night. With batteries, it is possible for some solar shoppers to get “off the grid” or to achieve “net-zero” energy. The Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics offers more information on the ITC including eligibility requirements.2

The Inflation Reduction Act has already boosted America’s clean energy economy. A September 2023 report tells us that investment in clean energy in the U.S. was $213 billion over twelve months, an annual increase of 37% and a 165% increase compared with five years ago.3 To put this in perspective, the $213 billion newly invested in clean energy is larger than the Gross Domestic Product of 18 of the 50 U.S. states!

billion newly invested in clean energy is larger than the Gross Domestic Product of 18 of the 50 U.S. states!

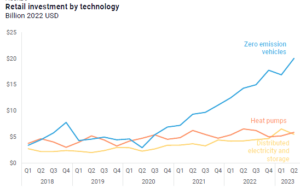

Over the past year, U.S. households and businesses bought $30 billion worth of electric cars, renewable energy generation, storage, and efficient heat pumps (see Figure). It is not known what proportion of these purchases were made by health professionals and practice managers, but why would anyone want to miss this opportunity?

There are many ways for businesses to finance solar projects, from traditional loans to capital leases and operating leases. Leasing is an operating expense which has the added benefit of being tax deductible. Businesses may also be able to take advantage of Modified Accelerated Cost Recovery System (MACRS) depreciation.

Solar power is a low risk investment that serves as a protection against future electricity rate increases, while reducing operating expenses and making a statement about the practice’s commitment to sustainability. “Going solar” also improves the “culture” of your business. People are proud to work in a renewable energy building. They commonly become eager to turn off lights, to recycle, to look for ways to save water, and to make other environmentally friendly, money-saving choices. A “green” office has tangible benefits for the morale of your colleagues and for the public image of your practice. Your patients will notice and be pleased!

If you work in a large medical practice or a hospital, another option is to hire an Energy Performance Contractor (EPC), also called an Energy Service Company (ESCO). These are consultants who take a comprehensive look at your business’ energy use. They may make substantial changes to your buildings, such as upgrading windows, insulation and air conditioning systems, adding solar panels, and changing the management of energy systems. EPC’s are paid solely from the savings in the client’s energy bill. The U.S Department of Energy offers a guide to EPCs and ESCOs.4

“Your patients will notice and be pleased!”

Perhaps the best reason to choose solar electricity is the health of your patients and of your community. The electricity company does not need to burn as much dirty fossil fuel when we instead generate power  from the sun. The image on the left shows rooftop panels being installed in 2019 at the Escambia County Health Department (ECHC) in Pensacola, Florida, USA. Those panels are saving the clinic more than $6,000 per year but also are lowering air pollution such as asthma-producing nitrous oxide and climate-warming carbon dioxide. Learn more about ECHD at https://mygreendoctor.org/profiles/.

from the sun. The image on the left shows rooftop panels being installed in 2019 at the Escambia County Health Department (ECHC) in Pensacola, Florida, USA. Those panels are saving the clinic more than $6,000 per year but also are lowering air pollution such as asthma-producing nitrous oxide and climate-warming carbon dioxide. Learn more about ECHD at https://mygreendoctor.org/profiles/.

Call a local licensed solar power contractor today to make an appointment for a free estimate of what solar panels will cost you and how much money and greenhouse gases you will save. Most rooftop solar installations are completed in a few days. After that, no maintenance is required. You can enjoy lower electricity bills and know you are helping to improve community health. You can do this!

Resources:

- Savings are estimated by Net Present Value methods. Tan E, Lim D. Carbon Footprint of Dermatologic Surgery. Australas J Dermatol. 2021; 62: e170-e7. doi: 10.1111/ajd.13522. 33277919 & Personal Communication 9.18.23

- Homeowner’s guide: https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

- September 2023 report from Rhodium Group: https://rhg.com/research/clean-investment-monitor/. The Figure is adopted from Reference 3.

- https://www.energy.gov/scep/slsc/energy-savings-performance-contractingenergy

Photo Credits:

- Solar rooftop Installation US Dept Energy Dennis Schroeder, National Renewable Energy Laboratory accessed 9.2023

- Courtesy of Escambia County Health Department, Pensacola, FL

About the Author:

Todd L Sack MD, FACP is Editor of My Green Doctor, the world’s leading open access environmental sustainability program for outpatient healthcare offices, clinics, and other facilities. Register today at www.MyGreenDoctor.org. Please tell your colleagues about My Green Doctor and consider making a tax deductible donation to this all-volunteer, charitable project.

Todd L Sack MD, FACP is Editor of My Green Doctor, the world’s leading open access environmental sustainability program for outpatient healthcare offices, clinics, and other facilities. Register today at www.MyGreenDoctor.org. Please tell your colleagues about My Green Doctor and consider making a tax deductible donation to this all-volunteer, charitable project.