The Inflation Reduction Act (IRA), adopted in 2022, presents significant opportunities for outpatient clinics and group practices to reduce operational costs through energy efficiency improvements. By upgrading HVAC systems, switching to LED lighting, and utilizing renewable energy, clinics can cut expenses while also reducing their environmental impact.

My Green Doctor provides a short guide to using the IRA to capture as much as a $15,000 credit for installing solar panels on your home or business roof.

This article explores specific cost-saving benefits from the IRA for group practices and outpatient clinics, including tax credits, rebates, and real-world savings data.

My Green Doctor can help guide you through these options. Contact us today!

Heather Massey, Sustainability Programs Manager

[email protected]

(469) 877-4608

How Clinics Can Save on Energy Costs

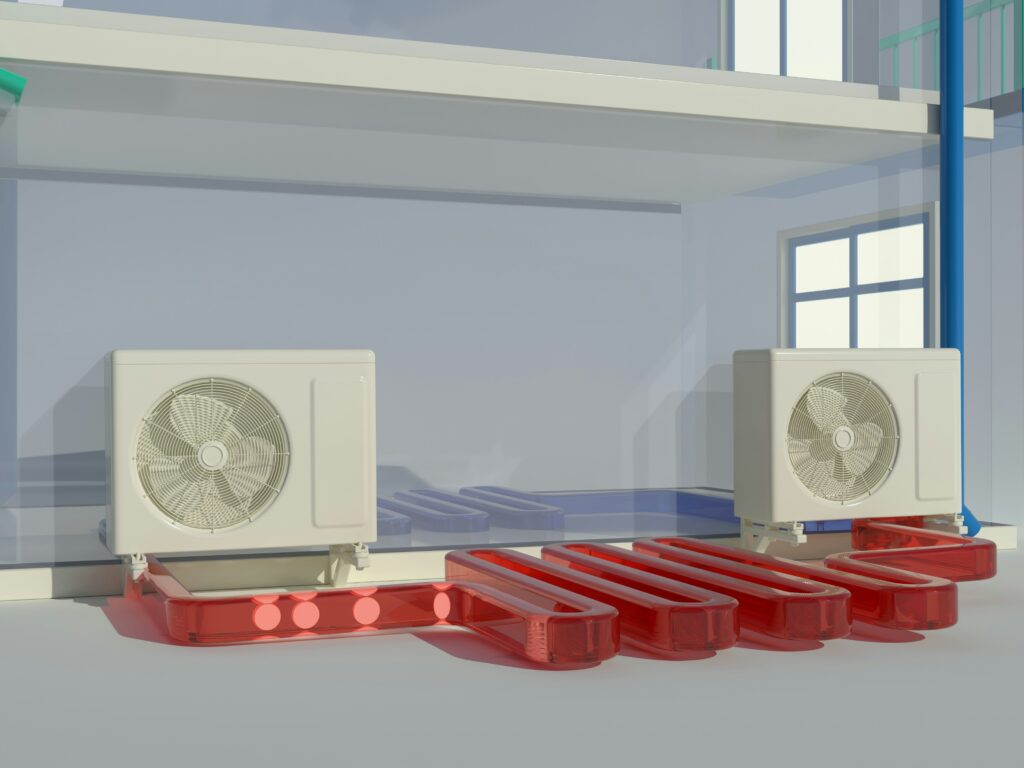

1. Lower Utility Bills with Energy-Efficient HVAC & Heat Pumps

One of the biggest energy expenses for clinics is heating and cooling. Many practices operate in older buildings with inefficient HVAC systems, leading to high utility costs.

The IRA provides tax credits and deductions for energy-efficient HVAC upgrades, including heat pumps, which provide both heating and cooling while using 30% to 60% less energy than traditional systems (EnergySage).

- Potential Savings: A 30% energy reduction could save a clinic with $20,000 annual HVAC costs between $6,000 and $10,000 per year.

- IRA Incentive: The Investment Tax Credit (ITC) offers up to 30% back on the cost of heat pumps and energy-efficient HVAC systems (EPA).

2. LED Lighting: 75% Less Energy Use

Switching to LED lighting is one of the easiest and most cost-effective energy efficiency upgrades for medical offices. LEDs use 75% less energy and last 25 times longer than traditional bulbs (DOE).

- Potential Savings: If a clinic spends $10,000 per year on lighting, switching to LEDs could save $7,500 annually.

- IRA Incentive: Clinics can use the 179D Energy Efficient Commercial Buildings Deduction, which provides tax deductions for lighting upgrades (IRS).

3. Solar Energy: Lower Energy Bills + IRA Tax Credits

The IRA provides a 30% tax credit for solar panel installations in commercial buildings, which includes outpatient clinics and group practices (EPA).

- Potential Savings: A clinic that installs a $50,000 solar system could receive a $15,000 tax credit and save $5,000 to $10,000 per year on electricity costs.

- Bonus: Selling Excess Energy: Clinics in some states can sell excess solar power back to the grid, generating additional revenue.

4. Energy-Efficient Building Upgrades

Many outpatient facilities operate in older buildings with poor insulation, leading to higher heating and cooling costs. Simple upgrades, such as better insulation, energy-efficient windows, and automatic thermostats, can significantly cut energy use.

- Potential Savings: Clinics that improve insulation and install smart thermostats can reduce total energy costs by 10-20%, saving $5,000 to $10,000 per year for a $50,000 annual energy bill (Better Buildings).

- IRA Incentive: The 179D deduction provides tax incentives for improving building energy efficiency.

Case Study: A Real-World Example of Energy Savings

Hackensack Meridian Health, a healthcare network in New Jersey, reduced energy costs by 20% after upgrading its Building Automation System (BAS) and HVAC at its Medical Plaza outpatient clinic. This translated into thousands of dollars in annual savings while improving patient comfort (Better Buildings).